NFC technology is secure, as is our company. We are the most certified in the identity verification industry: ISO27001, ISO27701, and eIDAS-compliant certified under ETSI EN 319 401 and ETSI EN 319 411-1/2 standards. We are regularly audited and pen tested, and comply with EBA outsourcing guidelines. Inverid is based in the EU and is GDPR compliant.

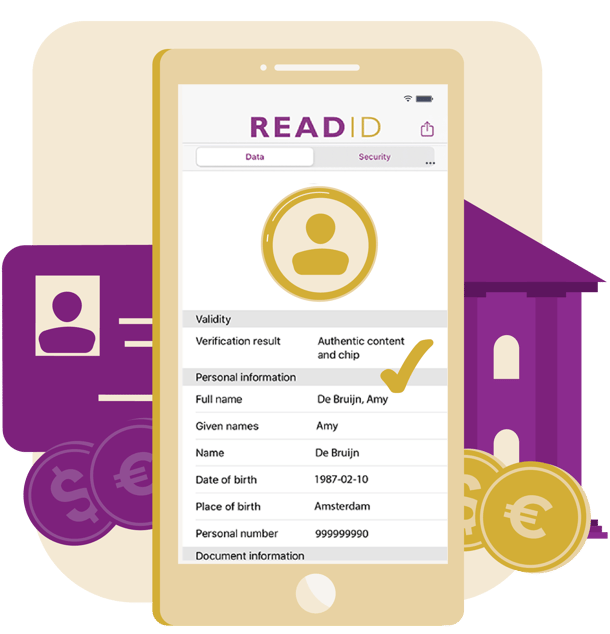

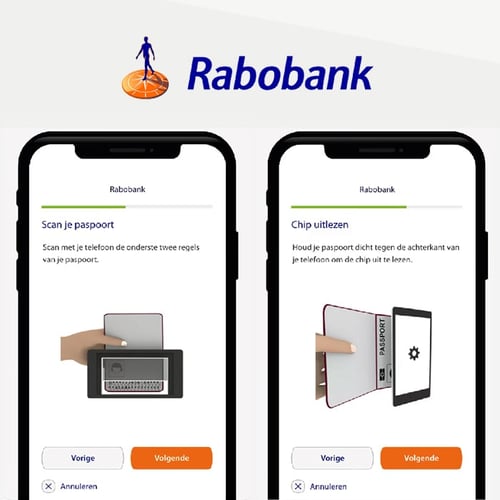

We build upon electronic identity documents that are impenetrable: data in electronic identity documents cannot be manipulated and is always correctly read. We can detect if a chip was copied. Face images in chips cannot be manipulated and have a higher resolution than the printed face image on a physical identity document. This prevents identity fraud and provides a much stronger basis for face verification than optical solutions.

Thanks to these inherent security measures, NFC-based identity verification is also deepfake proof, giving your bank the ultimate defence against identity fraud prevention.